Successful Real Estate Investors Maximize Net Operating Income

Ever notice how some real estate investors always have positive cash flow and meet their monthly expenses with room to spare. This wondrous fact is no accident. These professionals run their real estate investments like a business and follow sound practices to maximize net operating income (NOI).

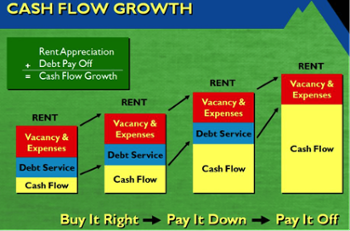

NOI simply put is what you have left from your gross rental income after you have accounted for vacancies and paid operating expenses. So how do you maximize NOI? Three simple ways: increase gross rental income, control expenses and minimize vacancies.

Area investors are invited to learn about NOI and other aspects of real estate investing by working with successful real estate investor Kevin Mackessy at Blue Olive Properties, a Highlands Ranch based property management and real estate investment company.

Increase Gross Rental Income

So how do successful investors consistently increase gross rental income? The best way is to include a rent escalator in all leases. Using an escalator means the rent will increase without question or negotiation. An escalator, when presented at the time the lease is signed, prepares the renter for scheduled increases up front. Another way to increase NOI is to make strategic improvements to the property to make it stand out, drawing tenants willing to pay a premium for nicer kitchens and bathrooms, or washers and dryers.

“We always get premium rents for the homes we buy and manage,” Mackessy says. “We improve them slightly above the neighborhood norm. We make sure the houses are painted, if needed, and quickly updated between tenants.”

Control Expenses

Controlling expenses is a natural way to increase NOI and is usually only a matter of record keeping and attention to details. Setting up a book keeping system or using a qualified property management company makes record keeping easy. Keeping the costs of repairs and improvements under control is essential in maximizing NOI. Having a viable network of professionals ready to help always saves time and money.

“We have a strong service network that we have built over the years,” Mackessy says. “We share our network contacts with our investors. We keep our expenses in check with volume pricing and the loyalty of our service providers.”

Improvements are a tax deductible expense, and the right ones add value to your property, increasing equity. The wrong ones are just deductions. There are four kinds of improvements: those that are necessary and add value, such as a new roof or flooring; unnecessary but add value, such as landscaping and cosmetic enhancements; necessary but don’t add value, such as plumbing and foundation repairs; unnecessary and don’t add value, such as expensive fixtures or amenities.

“The best landlords know how repairs and improvements impact NOI,” Mackessy says. “Good investors know that it is not always smart to minimize operating costs at the expense of income and equity gains.”

Minimize Vacancies

The key to minimizing vacancies is having a plan to keep tenants longer and market vacant properties faster. You must be ready to rehab, clean and market your vacancies quickly. You must know the rental market, or hire professionals who do.

“The Denver rental market is strong right now. We specialize in finding two, three, four, and even five year leases,” Mackessy says. “Making a house appealing for a long term tenant is crucial. Also, scheduling rent increases keeps your longer term leases from harming your NOI.”

So remember, run your rentals like a business. Keep good records and good tenants. Control your expenses. Use professionals. Once you learn these easy ways to increase your net operating income, you too will experience more cash flow and enjoy your own investment success.

Let's Talk