Law of Momentum Compounds Real Estate Investing Success

In real estate investing, everything big starts small. New investors often think that it will take “forever” for their investments to amount to anything. When considering their first real estate investment, most people find it hard to justify the time, money and effort for the returns they see. It can seem crazy to work so hard to find a rental property that may only yield a couple of hundred dollars a month. The short-term benefits just don’t seem to justify the sacrifices.

In his best selling book, The Millionaire Real Estate Investor, Gary Keller encourages readers to step past short term thinking and look at the implications of small investments. What you must understand is that there is a natural growth curve to momentum, known as compounding. What starts small and grows slowly builds in size and momentum over time.

Area investors can learn about the power of momentum and compounding by working with successful real estate investor Kevin Mackessy at Blue Olive Properties, a Highlands Ranch based property management and real estate investment company. Mackessy shares his own investing experience in creating momentum with his investors.

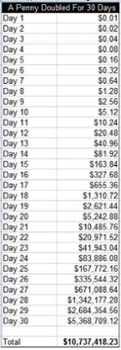

To illustrate the power of compounding Mackessy tells the story of an employee who negotiates a compounding pay scale where his pay doubles every day, but starts at just one penny. The employer quickly agrees, thinking he’s getting a deal. Unfortunately for the boss, if you do the math, 30 days of doubled pay that begins with a single penny ends with an invoice for $10.7 million.

Any form of investing is about putting your money to work and letting it work for you over time. Real estate investing is no different. What distinguishes real estate from other investments is that the original value of your asset tends to be large, and through the power of leverage, properties can be purchased for less out of pocket capital. For instance, if you bought a $100,000 investment property each year by putting 10% down, and achieved a modest 5% return on the total value of the assets, you would be a millionaire in less than a decade.

With each property you add to your portfolio, your portfolio grows. As your investments grow, so do your buying power and investment knowledge. That is the foundation for bigger and ever-increasing investments.

“Over the years, we have seen absolute beginners use our system and investment strategies, to build very nice, cash-flow generating real estate portfolios,” Mackessy states. “They started small, buying a single property.”

No matter what your current financial situation looks like, financial wealth is available to you. No matter how little money or knowledge you have in the beginning, a great ending is possible. The trick is to get started and then let the power of compounding take over for you. If you can believe that it is both possible and probable for you, it’s time to take the plunge and change your future.

Let's Talk